🤯 Bitcoin spends 56 times less energy than current monetary payment system

We talk about Bitcoin and how it is more energy efficient as well as margin call and what it means

gm haters 🫠

I know, all the crypto haters are out there telling you ‘told you so..’ and stuff like that. This shall pass, and it will pass soon so hang in there. We are currently sitting at $.9 trillion crypto market cap and somehow BTC and ETH have reached more like a low ‘stable’ level at this point.

Of course, this might not be the bottom low as we have seen lot of margin call cases lately. If BTC hits certain low levels, then we will see more sell-off pressure and that will bring prices even lower.

Btw, if you have never heard of margin call before, I’ll break it down for you.

Let’s say you want to buy BTC. You have $100k to buy BTC yourself, but you want to buy an additional $50k worth of BTC. You can use your current holdings (i.e the $100k worth of BTC you bought initially) as a collateral and get a loan for the other $50k.

Of course, getting a loan you have to pay interest on it. If all goes well and prices go up, you benefit from the gains minus the interest paid. However, if prices keep going down, there is a support level which is called the maintenance level, if you hit that then you risk being margin called. Meaning that, the collateral used initially to get the loan has been going down on value and if you want to keep the loan, you have to top it with additional funds so you don’t get margin called.

If you add additional funds, then you are safe for a while. If you do not add more funds, then institution you got the loan from goes out in the market and liquidates your collateral to get their money back.

Keep in mind, that collateral left as a deposit vs the loan you get will always be higher. In the current financial system, collateral is around 120-130% of the loan.

In crypto space, considering the high volatility in the markets, it is around 150-200% collateral of the loaned amount.

This is what might happen to Michael Saylor, the co-founder of MicroStrategy who went all in with bitcoin. He got a $205 million loan (3yrs loan) from Silvergate (crypto bank) to buy more bitcoin and used his bitcoin holding as collateral to get the loan. Rumor has it that he got already margin called, but he denied it. On his tweet, he mentioned that they need to maintain $410 million level (if it goes lower, they get margin called) for the $205 loan (200% collateralized loan). If this happen to be true, next level for a margin call for MicroStrategy would be if BTC hits ~$3.5k level. Even if that happens, according to Saylor, they will still have some money to put as collateral.

Three Arrows Capital got margin called already. 3AC is a cryptocurrency hedge fund who did bet on a lot of cryptocurrency tokens/projects (including Luna) by using loaned money from different institutions. Considering the crypto market plummeting in the last couple months, some of the biggest lenders who gave money to 3AC were forced to liquidate some of their positions. One of their biggest crypto lender, BlockFi liquidated some of their positions and reduced their exposure.

Zac, CEO of BlockFi confirmed this already in one of his tweets.

Similar cases are bound to happen if crypto market hits lower levels. This will cause even more sell off pressure and bring it down even more as the retail investor panic sells seeing all the movements happening around. We never know what low level is the lowest. DYOR always, FOMO does not help always.

I am a firm believer that the technology that comes from blockchain is here to stay with us forever. Does that mean that prices will go up? Not necessarily. You can have a stable coin (obviously something far away from UST) which does not increase/decrease in value but still use the technology and ease of use that comes with the underlying blockchain.

One thing is for sure though. Times like this will differentiate those who are believers in the blockchain technology and those who are in the space for speculative purposes. Time to shine for those who build stuff using this technology.

🤯 Bitcoin spends 56 times less energy than current monetary payment system

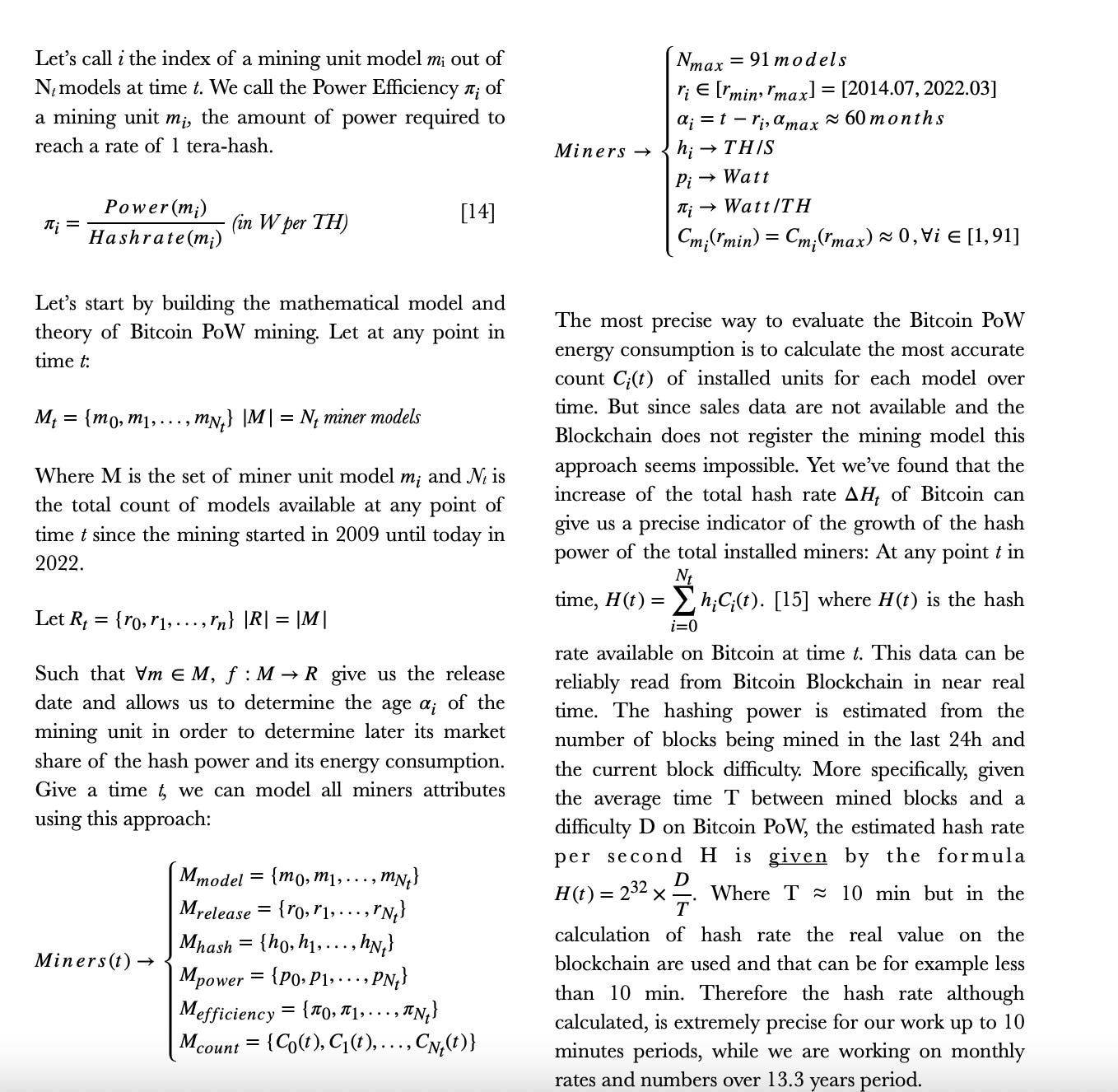

There is a research report from Valuechain that came out recently. This research comes as a results of so many critics arguing that Bitcoin in its mining operations uses a lot of energy which makes it not feasible and way more expensive than the current monetary payments system.

Based on their research, it appears that Bitcoin spends 56 times less energy than the current monetary payment system.

We demonstrate that Bitcoin consumes 56 times less energy than the classical system, and that even at the single transaction level, a PoW transaction proves to be 1 to 5 times more energy efficient. When Bitcoin Lightning layer is compared to Instant Payment scheme, Bitcoin gains exponentially in scalability and efficiency, proving to be up to a million times more energy efficient per transaction than Instant Payments.

If you want to check out the report, this is how it feels. Whenever I see stuff like this, greek letters and a bunch of math, it has to be true.

Hey there! With whom we can connect to discuss collaboration opportunities? :)