GM degens 🥸 How’s Monday treating ya?!

Let’s get into it. Not much happening those days in the crypto space. Same old same old. We have BTC and ETH around the same levels we had them last week.

Our lunch menu for today

🧜🏻♂️Here is what we know so far about BAYC Otherside Land Sale

🤸🏻♀️Interesting stats on how crypto hiring is booming and why you should consider a career switch

📟Documentary worth watching

🗞️ Other news in the space

🧜🏻♂️Here is what we know so far about BAYC Otherside Land Sale

In one of our previous newsletter, we briefly covered Otherside Metaverse project from Yuga Labs (creators of BAYC), but it was entirely based on the rumors at that time. You can read it below.

Now, we got a couple of confirmations from Yuga Labs. Their Otherside Meta is minting on April 30th from 12PM ET (if you are not in the same timezone, google for a timezone converter). You can join their Discord on the link below where they will be posting the official announcements.

While we are not going to cover the entire presentation which was leaked a couple weeks ago, you can refer to in the tweet below, which was posted on reddit as well.

Based on the presentation, here is what we have so far about the sale happening on April 30th:

Sale in $APE via Dutch Auction

10k Alpha Land (for BAYC holders)

20k Alpha Land (for MAYC holders)

55k for Public Sale - Normal Land

15k for contributors - Normal Land

There will be a max of 45 mints per address, capped to 20 max mints per transaction.

Please be aware of scams and do not FOMO without making sure that mint information is official and not a hack. One of the admins for Otherside Meta posted earlier an Announcement where it looks like BAYC Instagram was hacked so people thought there is a mint happening today. Pretty sure a lot of people fell for this and lot of ETH will be lost. Good luck everyone and stay safe out there. It is Wild West of NFTs!

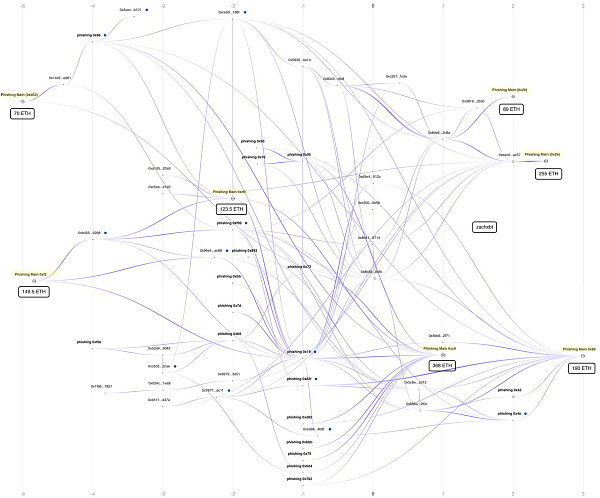

Btw, here is another interesting post from @zachxbt (a Twitter account you should definitely follow) about Discord hacks happening over the past couple of months and how they managed to steal a couple of millions of dollars.

🤸🏻♀️Interesting stats on how crypto hiring is booming and why you should consider a career switch

There is an entire report from LinkedIn Economic Graph on this, which I will try to quickly summarize it for you.

According to the report, U.S. last year, net crypto hires rocketed 73% from two years earlier. To give you some perspective on that, net number of hires in the traditional finance industries declined by 1% over the same period.

San Francisco is leading in the hiring space with roughly 10.2% of the market share followed by Austin and NYC. Miami seems to be on the 4th position, although I would expect this one to change by the end of this year.

One thing that is for sure, web3 is here to stay and we will see a lot more people switching careers and trying to fit in the web3 era. The good thing about web3 is that you will be able to have an anonymous profile where no one cares about your title, credentials. As long as you will be able to do the job, they won’t really care about your background. Something we have seen in the space already. Lot of developers in web3 have no bachelors in CS or anything similar, simply self-taught individuals capable of delivering quality work.

For this exact reason, we will be starting our job portal soon where we will be posting different roles for the web3 space. Stay tuned.

📟 Documentary worth watching

$250 million of bitcoin randomly disappears from QuadrigaCX, once Canada's largest crypto exchange, and the only person who can get it back mysteriously dies. Greed is a matter of life and death in this true crime documentary about the rise and fall of QuadrigaCX, the mysterious death of its founder Gerry Cotton, and the victims left behind to pick up the pieces.

Here is the trailer.

Not going to spoil it but basically this issue has not been figured out yet and investigation is still going on.

🗞️ Other news in the space

Musk edges closer to Twitter deal

Crypto boom opens door to a new class of landlords

The World’s First Regulated Crypto Bank Braces For Flood Of Institutional Money