🪶 Terra Luna 2.0 is coming tomorrow

Existing holders will be airdropped with LUNA tokens on May 27th, 2022

Seriously, another newsletter about Luna?! I am outta here..Hold on, hear me out. I promised I won’t be writing about it anymore unless something major happens. Well, guess what? That time has come. Whether this will be a successful move or not, that we have to wait and see, but for that it is going crazy on news, that’s for sure. If you are not familiar with the issue of Luna Terra (chances are low), then you should definitely check out our previous newsletter below where we explain the details of what exactly happened.

🪶 Terra Luna 2.0 is coming tomorrow

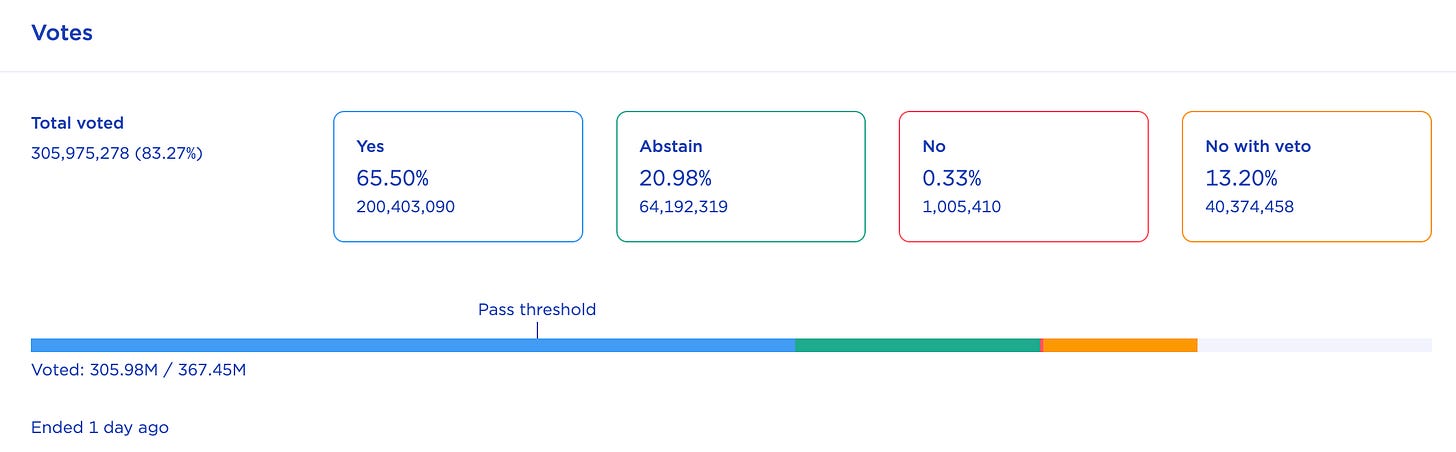

Wait, what does this even mean?! Do Kwon came up with a proposal of creating a new Terra chain, this time without the stable coin where existing holders of the ‘old’ Luna will be airdropped with the ‘new’ Luna. The old chain then will be called Terra classic (LUNC) while the new chain to be called Terra ( while token Luna - LUNA). He added this proposal for a vote among Terra holders, where roughly 65% of them agreed with the proposal, which means Terra Luna 2.0 is happening, and that will be tomorrow, May 27th, 2022.

TerraForm Labs [TFL’s wallet (terra1dp0taj85ruc299rkdvzp4z5pfg6z6swaed74e6)] will be removed in the whitelist for the airdrop, making Terra a fully community owned chain.

Who is eligible for this?

Pre-attack Luna holders distribution - for all holders with balances of 10k Luna or less, they get 30% of it unlocked at genesis, while the other 70% vested over 2 years (6 months cliff).

Post-attack UST holders distribution - 20% → 15%. This is to ensure that depeg related allocation is on par with the original stakeholder (pre-attack Luna) allocation. The 5% saved goes to the community pool.

Increase initial float: all initial float allocations modified from 15% → 30% to increase initial token float.

Token Distribution

Community pool: 30%

Controlled by staked governance

10% earmarked for developers

Pre-attack LUNA holders: 35%

All bonded / unbonding Luna, minus TFL at “Pre-attack” snapshot; staking derivatives included

For wallets with < 10k Luna: 30% unlocked at genesis; 70% vested over 2 years with 6mnth cliff

For wallets with < 1M Luna: 1 year cliff, 2 year vesting thereafter

For wallets with > 1M Luna: 1 year cliff, 4 year vesting thereafter

Pre-attack aUST holders: 10%

500K whale cap - covers up to 99.7% of all holders but only 26.72% of aUST

30% unlocked at genesis; 70% vested over 2 years thereafter with 6 month cliff

Post-attack LUNA holders: 10%

Staking derivatives included

30% unlocked at genesis; 70% vested over 2 years thereafter with 6 month cliff

Post-attack UST holders: 15%

30% unlocked at genesis; 70% vested over 2 years thereafter with 6 month cliff

🦚 WeWork co-founder Adam Neumann joins the space with a crypto project

All of sudden, the controversial billionaire is back. This time with a crypto venture hoping to solve problems with climate change. Btw, if you have not seen WeCrashed, you are definitely missing a lot. It explains the entire saga of what happened and how it went from WeWork to WeCrashed. Adam though, was able to get out of this in pretty good position, thanks to his deal to get hundreds of millions of dollars if for whatever reason they decide to fire him as a CEO at WeWork at that time. He is still billionaire, with net worth of more than $2 billion.

His new project is called Flowcarbon. He is taking carbon trading on Blockchain. Btw, if you don’t know what carbon trading is, check the definition below.

Carbon trade is the buying and selling of credits that permit a company or other entity to emit a certain amount of carbon dioxide or other greenhouse gases. The carbon credits and the carbon trade are authorized by governments with the goal of gradually reducing overall carbon emissions and mitigating their contribution to climate change.

His rationale behind such move with Florcarbon, is that “While thousands of corporations have committed to net zero carbon emissions over the next few decades, we are not moving fast enough”.

Btw, there is a huge market for carbon credits. Now, with Flowcarbon project, instead of going through the old trading way, everything will be on blockchain which gives more transparency as well as faster transactions.

They have decided to call their token as Goddess Nature Token (GNT). He already got funded with $70 million from a16z. Whether Neumann will be able to pull it off or not with Flowcarbon project, one issue is that people have trust issues.

🐦 Tweet of the day

We have reported about this in one of our previous newsletters, seems like Windvane (KuCoin’ marketplace) is live now.

📰 Other news in space

a16z raises a new $4.5 billion crypto fund - As per their comment, “We’ve been investing in crypto since 2013, and today we’re announcing our fourth crypto fund, totaling $4.5B. Of that, approximately $1.5B will be dedicated to seed investments, and $3B to venture investments. This brings our total crypto/web3 funds raised to over $7.6B.”

Andreessen Horowitz raises $600M venture fund for games

Crypto collapse ‘wake-up call' and 'opportunity to reset,’ top bank regulator says

Crypto Exchanges Including Binance, FTX To Support 'Terra 2.0' Relaunch